SET-listed banks recorded 12% year-on-year earnings growth in the third quarter of this year, supported by higher fee-based income despite a decline in interest income and loan contraction.

Please credit and share this article with others using this link: https://www.bangkokpost.com/business/general/3125020/thai-listed-banks-earnings-rise12-in-q3. View our policies at http://goo.gl/9HgTd and http://goo.gl/ou6Ip. © Bangkok Post PCL. All rights reserved.

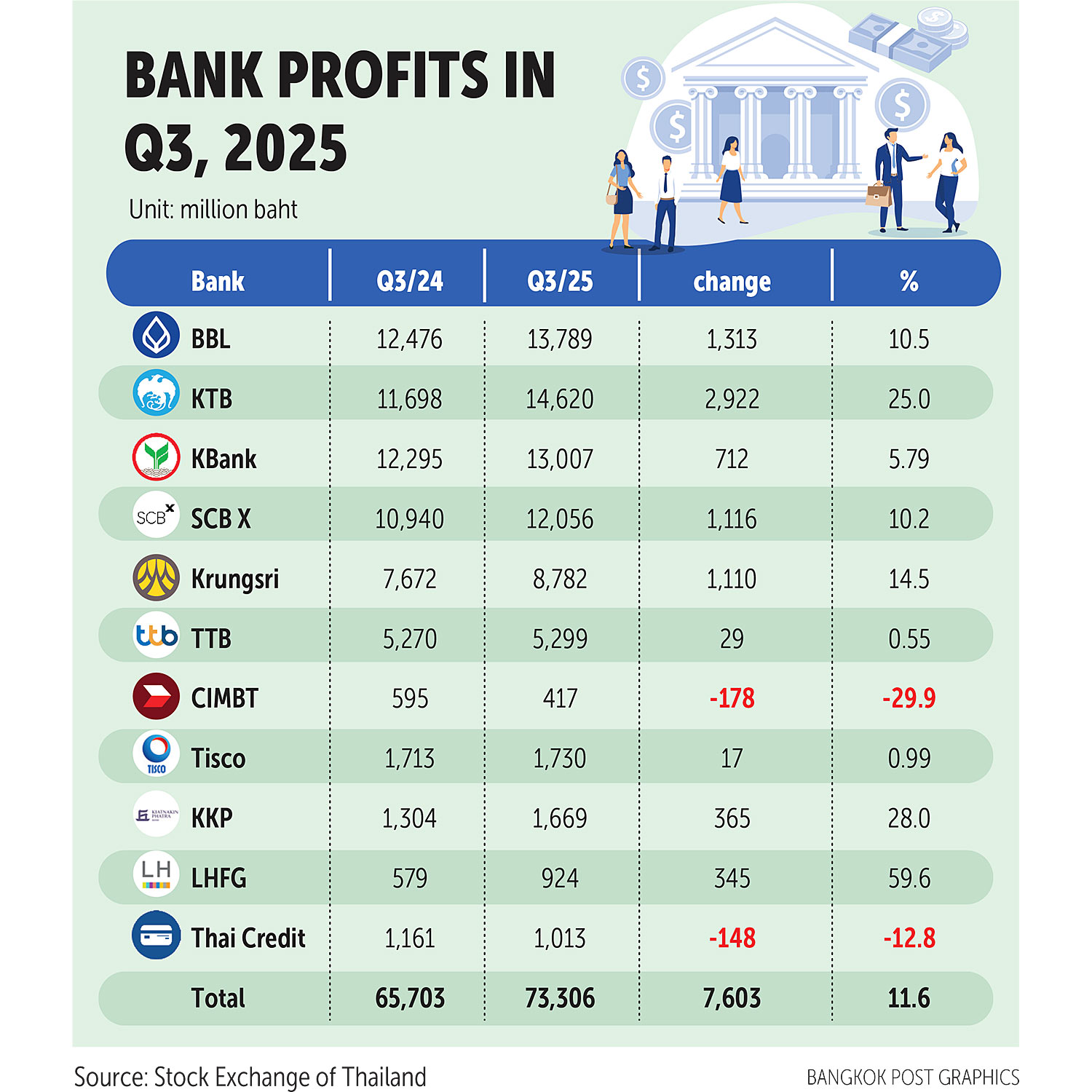

The 11 banks listed on the Stock Exchange of Thailand reported a combined consolidated net profit of 73.3 billion baht, up 11.6% year-on-year.

Land and Houses Financial Group, a smaller bank, posted the sector’s highest net profit growth at 59.6%, reaching 924 million baht.

In contrast, CIMB Thai Bank was the only lender to record a profit decline, down 29.9% to 417 million baht.

Among Thailand’s six domestic systemically important banks (DSIBs), Krungthai Bank (KTB) achieved the highest net profit, reporting 14.6 billion baht for the third quarter, an increase of 25% year-on-year.

Please credit and share this article with others using this link: https://www.bangkokpost.com/business/general/3125020/thai-listed-banks-earnings-rise12-in-q3. View our policies at http://goo.gl/9HgTd and http://goo.gl/ou6Ip. © Bangkok Post PCL. All rights reserved.

The other five DSIBs comprise Bangkok Bank (BBL), Kasikornbank (KBank), SCB X (the holding company of Siam Commercial Bank), Krungsri (Bank of Ayudhya), and TMBThanachart Bank (ttb).

Overall profit growth was primarily driven by non-interest income, particularly from gains on investments and fee-based income related to wealth management businesses.

However, net interest income (NII) declined across the industry, in line with the central bank’s policy rate cut.

The Monetary Policy Committee (MPC) has lowered the policy rate four times since October 2024, reducing it by 100 basis points (bps).

In 2025, the MPC made three consecutive cuts of 25 bps each in February, April and August. The MPC has since kept the rate unchanged, maintaining it at 1.5%.

For the third quarter, the six DSIBs reported combined NII of 161 billion baht, down 7.69% year-on-year. The decline was led by ttb (-11.8%), followed by SCB X (-9.87%), BBL (-7.84%) and KBank (-6.91%). Krungsri was the only DSIB to record NII growth, rising 2.46%.

According to KTB’s financial statement for the third quarter, its improved net profit was mainly supported by a 3.7% increase in fee income, driven by wealth management, global markets and investment gains, while NII declined due to lower interest rates.

Amid sluggish Thai economic growth, the total outstanding loans of the six DSIBs fell to 13.1 trillion baht as of September 2025, representing a 1.36% decrease from the end of last year.

KTB, the country’s second-largest lender by assets, posted the steepest loan contraction at 3.94%, followed by ttb (-3.5%), BBL and SCB X (-3.2% each), and KBank (-2.7%). Krungsri was the only DSIB to report loan growth, rising 2.7% over the period.

https://www.bangkokpost.com/business/general/3125020/thai-listed-banks-earnings-rise12-in-q3